In a recent article in the Australian Financial Review, Alvia Chief Executive, Nathan Robertson, shared insights on shifting trends in the portfolios of high-net-worth (HNW) Australians. With 55,000 more Australians joining the ranks of HNW investors this year, Nathan discussed how stabilising interest rates and buoyant asset prices have spurred affluent investors to take on more risk, with many increasing their allocation to growth assets like private equity.

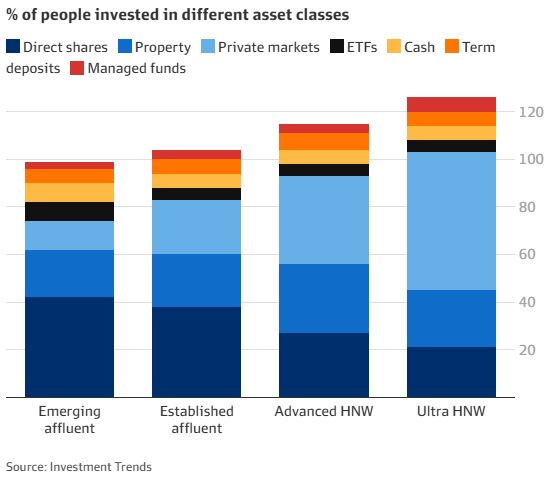

Private market investments are becoming a prominent choice among wealthy Australians, with 21% of HNW individuals now active in private markets. Nathan highlighted that ultra-high-net-worth (UHNW) investors, in particular, are comfortable with illiquid assets, understanding their investments in private markets as long-term and even multi-generational. As Nathan explained,

“Ultra HNWs have a much longer time horizon; they’re thinking about their wealth not just in terms of five, 10, or 15 years, but generationally and therefore having larger exposure in illiquid markets is much more tenable than for retail investors”.

While private markets offer significant upside potential, Nathan cautioned that these investments also come with risks, especially for less experienced investors. With more diverse portfolios, Australia’s affluent investors are strategically shifting to higher returns and alternative assets, yet Nathan emphasised the importance of expertise and caution when entering these complex asset classes, given the potential for prolonged lock-up periods in times of market stress.

Read the full piece by clicking on the link below.