August 2025

When we were setting up Alvia Asset Partners back in June 2020, there was no ribbon-cutting ceremony, no mahogany table, and no designer fit-out. What we had instead was a bare office, a few cardboard boxes of flat-pack furniture, and a team willing to roll up their sleeves.

I remember our first “boardroom meeting” vividly. There we were: myself, portfolio managers, and analysts all sitting cross-legged on the floor, allen keys in hand, trying to turn a pile of parts into what would eventually become our boardroom chairs. For that afternoon, job titles were irrelevant. Everyone was a handyman. The pile of chair legs and backrests scattered across the floor was both comical and symbolic – at once a mess and a beginning.

We were excited, but also more than a little terrified. Just days earlier, we’d committed our own capital to seed the Alvia Family Office Fund. The world outside was in chaos – the middle of a pandemic, markets swinging wildly, uncertainty everywhere. Launching a new fund then might have seemed reckless. But for us, it was a leap of faith in the philosophy we believed in: protect capital first, take risk only when it’s worth taking, and focus relentlessly on process over prediction.

That day, as screws rolled under desks and half-built chairs wobbled, there was a sense we were building something lasting – not just the furniture, but a foundation for the years ahead.

Looking back, that scene captures something essential about Alvia. Everyone pitched in. Nobody was above doing the unglamorous work. And while none of us were especially good at assembling chairs, we were very clear on what we wanted to build: a team willing to share the load, a process that would stand up under pressure, and a fund designed to last decades.

Fast forward five years and some things have changed. We’ve just moved into a bigger, better office, where the furniture came pre-assembled (thankfully). The debates about whether we could afford to upgrade the kettle are behind us. Our team has grown in number and in capability, with a culture stronger than any office fit-out could ever convey.

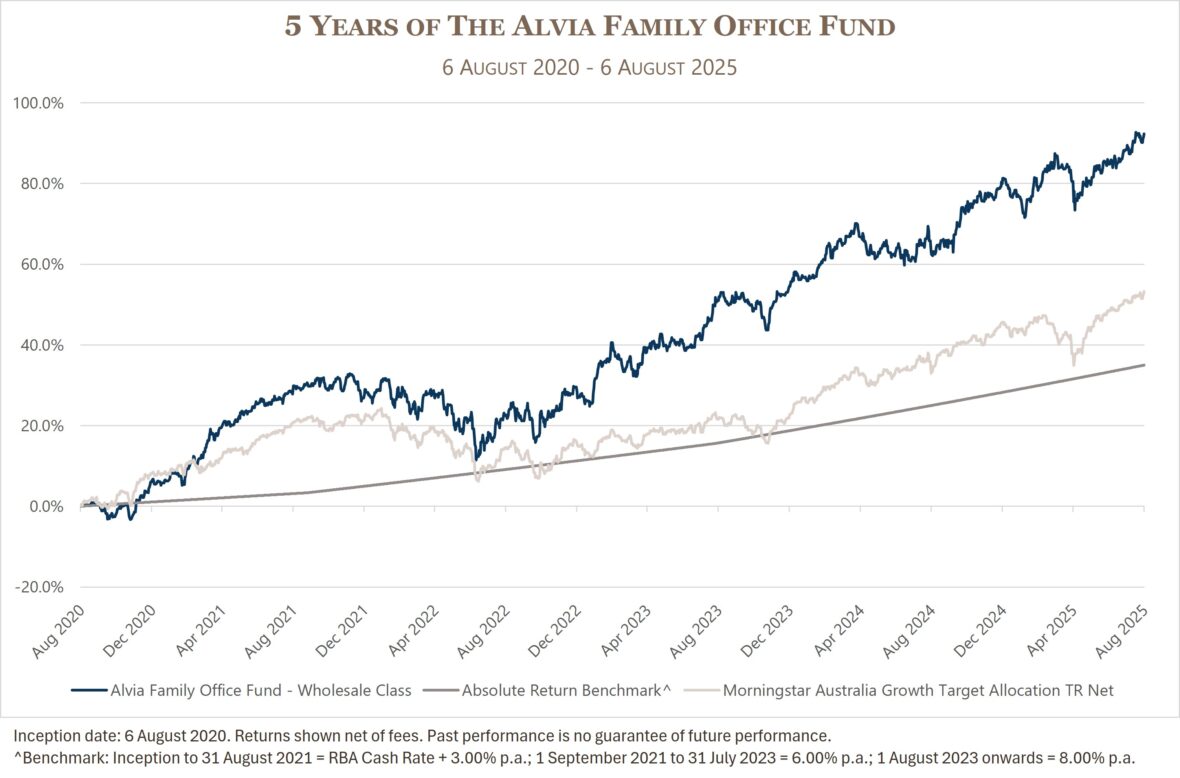

The Fund has grown too. Over the five years from inception in August 2020, the Alvia Family Office Fund has returned 14.0% per annum, net of fees, comfortably ahead of our 8 to 12% objective and placing it in the top quartile amongst its peers over one, three and five years. Importantly, these returns have been delivered with lower volatility, low correlation to traditional markets, and an unwavering focus on protecting capital first.

The spirit of those early days remains. We’re still happiest doing the unglamorous work, poring over financials, and staying patient when others are rushing into the next investment fad. We don’t need to be first. We just need to be right, most of the time, and when we do get it wrong, own it, learn, and move on.

The past five years have been a reminder that building something durable takes patience, humility, and discipline. Assembling portfolios is not so different from assembling those first wobbly chairs: start with a solid foundation, be methodical, and don’t cut corners.

As we look to the next five years, we’ll keep approaching it the same way – one decision at a time, always risk-first.

And if the furniture wobbles again, at least we know where the allen keys are.

Josh Derrington

Chief Investment Officer

Alvia Asset Partners